Recently, we talked to HomeKeeper users and asked them how they certify their program applicants as income-eligible. Our stewardship standards make it clear that it’s essential for organizations to communicate eligibility requirements to applicants, but since every program and funder has slightly different income limits and reporting requirements, the implementation often varies by program.

Does your program have a documented process for how you and your staff certifies income, records the qualifying information, and stores accompanying documentation? If not, HomeKeeper can help systematize your process and gather income eligibility data in one searchable place. As a result, you’ll be able to:

- Quickly create the report your funders want on income eligibility

- Have confidence that your buyers met your eligibility requirements

- Easily communicate the income levels of the families you serve

- Ensure your policies are being consistently applied by your team

Read on to learn how HomeKeeper is helping make documenting income easier, more transparent and flexible as your funders requirements change.

HomeKeeper is flexible and can mirror your organization’s income certification processes.

When it comes to calculating a household’s gross income, and making any eligibility adjustments, HomeKeeper users can craft processes that work for them. Some of the most important Service File fields are:

- Annual Income (Gross) & (Eligibility)

- HUD Income Category

- Percent of AMI (Gross) & (Eligibility)

- Custom fields

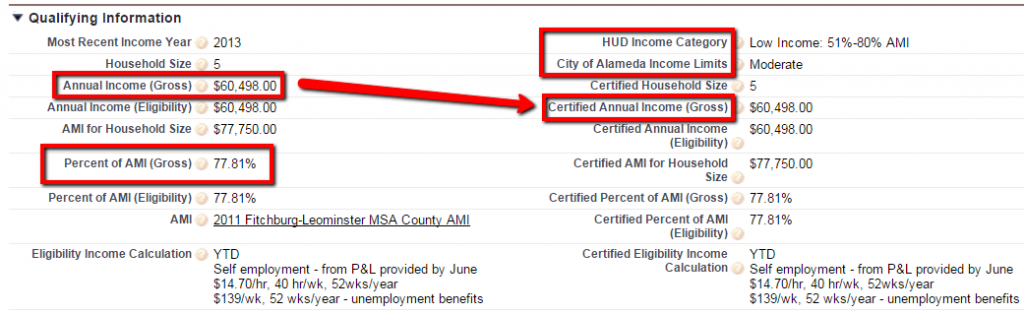

One of the most important actions a user can take is “certifying” the income, which copies the calculated values into Certified versions of those fields, and should mirror the time in a staff’s offline process when they’re making sure a potential buyer meets their programs and their funders’ income limits.

Programs leverage HomeKeeper to meet their income certification needs in different ways

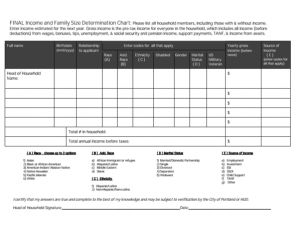

Calculate eligibility income totals offline, but capture gross income in HomeKeeper. For example, at Proud Ground in Portland, Oregon, Katie Ullrich uses two worksheets to document a family’s income eligibility calculations for their program, one to document all income sources signed by the applicant and another that documents program requirements, like income category, and front/back end ratios. She keeps supplemental documentation like pay stubs and verification of employments in her paper files, Only after all that, does she enters the information into HomeKeeper and certifies the income with the “Certify Income” button to match what’s already on her worksheets!

Calculate eligibility income totals offline, but capture gross income in HomeKeeper. For example, at Proud Ground in Portland, Oregon, Katie Ullrich uses two worksheets to document a family’s income eligibility calculations for their program, one to document all income sources signed by the applicant and another that documents program requirements, like income category, and front/back end ratios. She keeps supplemental documentation like pay stubs and verification of employments in her paper files, Only after all that, does she enters the information into HomeKeeper and certifies the income with the “Certify Income” button to match what’s already on her worksheets!

Calculate income eligibility in HomeKeeper and generate a summary document for the paper file.

Using a slightly different process, at Champlain Housing Trust, in Burlington, Vermont, nearly half the programs’ applicants submit an online form in place of a paper application. For those clients, it means program manager Jaclyn Marcotte doesn’t have to type information into Homekeeper. No matter how the application comes in Jaclyn collects and files similar pay stub, bank statement backup documentation as Katie, and then verifies the income against funder requirements. After she’s certified the income Jaclyn prints a summary sheet about the data in Homekeeper . It includes income information and more and provides a link between CHT’s paper files and their living Homekeeper database.

These are just two examples, but there are a multitude of possibilities. Some programs simply print out a screenshot of the Service File for applicants to sign. Other programs use the “Eligibility Verified” checkbox on the to make sure they have confirmed the applicant meets income and other eligibility requirements. What do you do?

HomeKeeper helps you ensure you’re meeting rigid HUD income eligibility criteria and helps you get a meaningful picture of your buyers true income ranges.

Many HomeKeeper users have to make sure they’re meeting HUD’s income limits, because they receive federal funds to do their work. This usually means the program manager has a chart of income limits taped to their wall, and have to see where an applicant’s income falls.

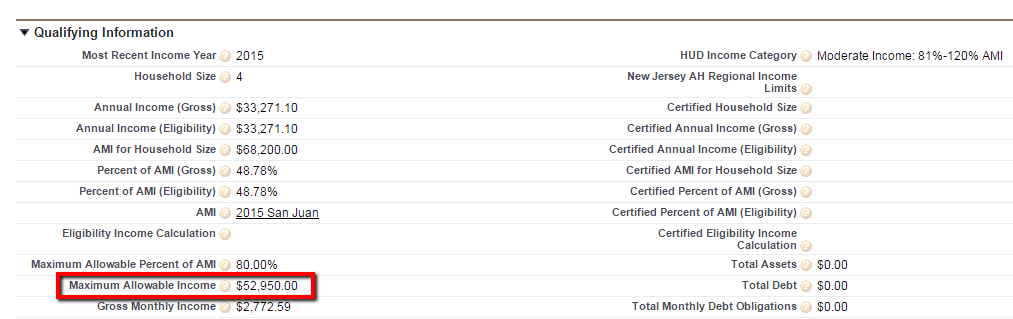

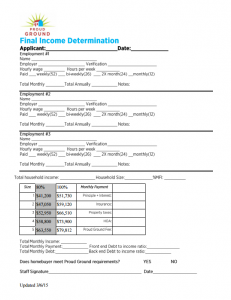

To fill in HUD Income Category, program staff still need to glance at the chart next to their desk, but compare the Annual Income total to the HUD Chart. Strangely enough, HUD’s Income Limits are labelled as if they’re directly related to 30, 50 and 80% values of Area Median Income, but they’re actually not always exact matches. In this example, you can see that this family of 4, was making more than the $33,100 limit for the “Very Low: 50%” category on the HUD’s Income Limit chart for San Juan County, so they belong in the next category of “Low 80%”.

This might be a bit confusing, because HomeKeeper’s formula field Percent of AMI calculates this family’s percent of AMI to be 48.7%, but it’s actually not a problem. Percent of AMI field isn’t mean to help you fill out the HUD income category. The HUD Income Category, along with any important funder limits should be hand checked by your team, while the Percent of AMI is meant to be used by your program or researchers to tell you literally, what percent of the 100% Area Median Income for that family size, was this household? This gives you tangible number to talk about in public, or to use if you collaborate with researchers. For example, “Our applicants average percent of Area Median Income was 62%.”

At OPAL Community Land Trust, on Orcas Island, Julie Brunner receives an online application and updates income sources in HomeKeeper as buyers give her backup documentation. She needs to keep several different income requirements in the back of her head:

- OPAL sets an income limit at 80% of Area Median Income (The value calculated in Percent of AMI)

- Buyers must also be below HUD’s Low Income (80% Income) Limits (She records this in HUD Income Category)

Because HUD’s income limit categories varied from the actual percentages this year Julie wanted a clear way to record the maximum income threshold her buyers were below when OPAL certified their income. To do this, she compares the Annual Income with the maximum limit on her funder chart (HUD’s Low 80% value) and enters that amount into the Maximum Eligible Income field on the Service File. Once she has filled in this value, she certifies the income with the “Certify Income” button.

HomeKeeper lets you add new fields if you have unique income limit requirements for eligibility.

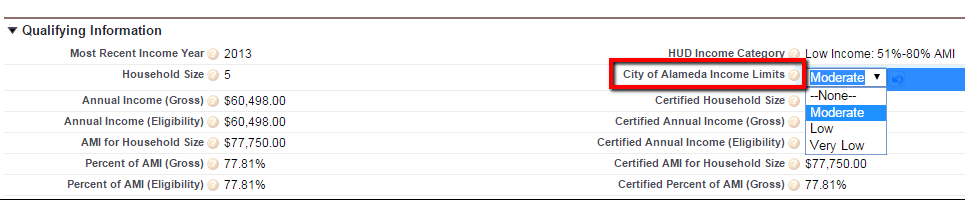

The Federal Government provides a lot of the funding for affordable homeownership programs, many HomeKeeper users share the HUD Income Limits as an eligibility and reporting requirement. Despite that, not all financing comes the Federal government, or uses HUD’s income limits in setting their own requirements.

Matt Warner works for Hello Housing, a nonprofit that provides stewardship services for several different municipal governments in California. In California, New Jersey and in some other states and cities across the country, the local government makes their own adjustments to HUD’s income limits, and sometimes even create their own income categories. This means when Matt looks to qualify a buyer for a City of Alameda program he’s got to look at the funder allowable income limits by household size for that City, and look at a chart, just like Julie does with the HUD Income Limits.

Luckily, Matt can create a City of Alameda Income Limits field in HomeKeeper, and place it right next to all of the other income eligibility fields in the Qualifying Information Section. To create a new field to capture your unique funder limits, read our how to in the HomeKeeper Support Forums.

HomeKeeper makes it easier to report on the income eligibility of buyers who receive both direct and indirect financing from your funders.

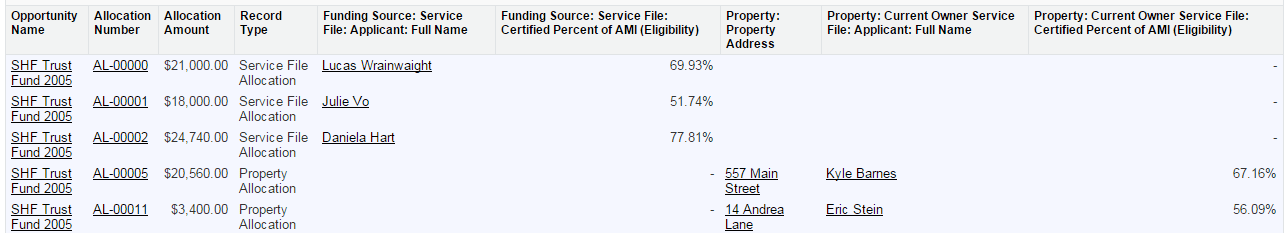

Once the hard work of getting buyers into homes finishes, the funder reporting begins! Sometimes grants or loans are allocated directly to buyers or are used for construction or rehabilitation, in HomeKeeper we call these Service File Allocations and Property allocations. Sometimes one grant might even be used for both purposes. In HomeKeeper it’s possible to show both buyers with direct, and indirect support from these funding sources met the funder’s requirements.

When Erika Malone at Homestead CLT found herself alone in the office on a Friday, she realized that she needed to get the city a report by the close of business. Homestead leveraged city financing for both downpayment assistance to buyers and for infrastructure financing for properties, and now the city needed the eligibility of buyers documented. Luckily for Erika, her team had recorded the city money as a Housing Opportunity, with Property and Service File Allocations. Using a customized report type, she could show the Percent of AMI for both recipients of downpayment assistance, and for families living in homes built using city money!

Conclusion

You know your programs and your reporting requirements best, so make sure you’re recording what you need in HomeKeeper to confidently certify eligibility and generate the compliance reports you need for funders. Not sure where to get started? Program staff like you have discovered that if they follow these steps, they get the best results:

- Identify your funders’ income eligibility requirements and reporting templates.

- Develop written procedures to document your process to determine income eligibility

- Adapt HomeKeeper as needed so that it reflects your process. Add picklist values. Add demographic fields. Add validation rules. As you acquire new funding, make sure HomeKeeper reflects any new limits or requirements for your funders.

- Train your staff so they know where and how to record this information in HomeKeeper

- Create the reports and merge documents you need for funders out of HomeKeeper